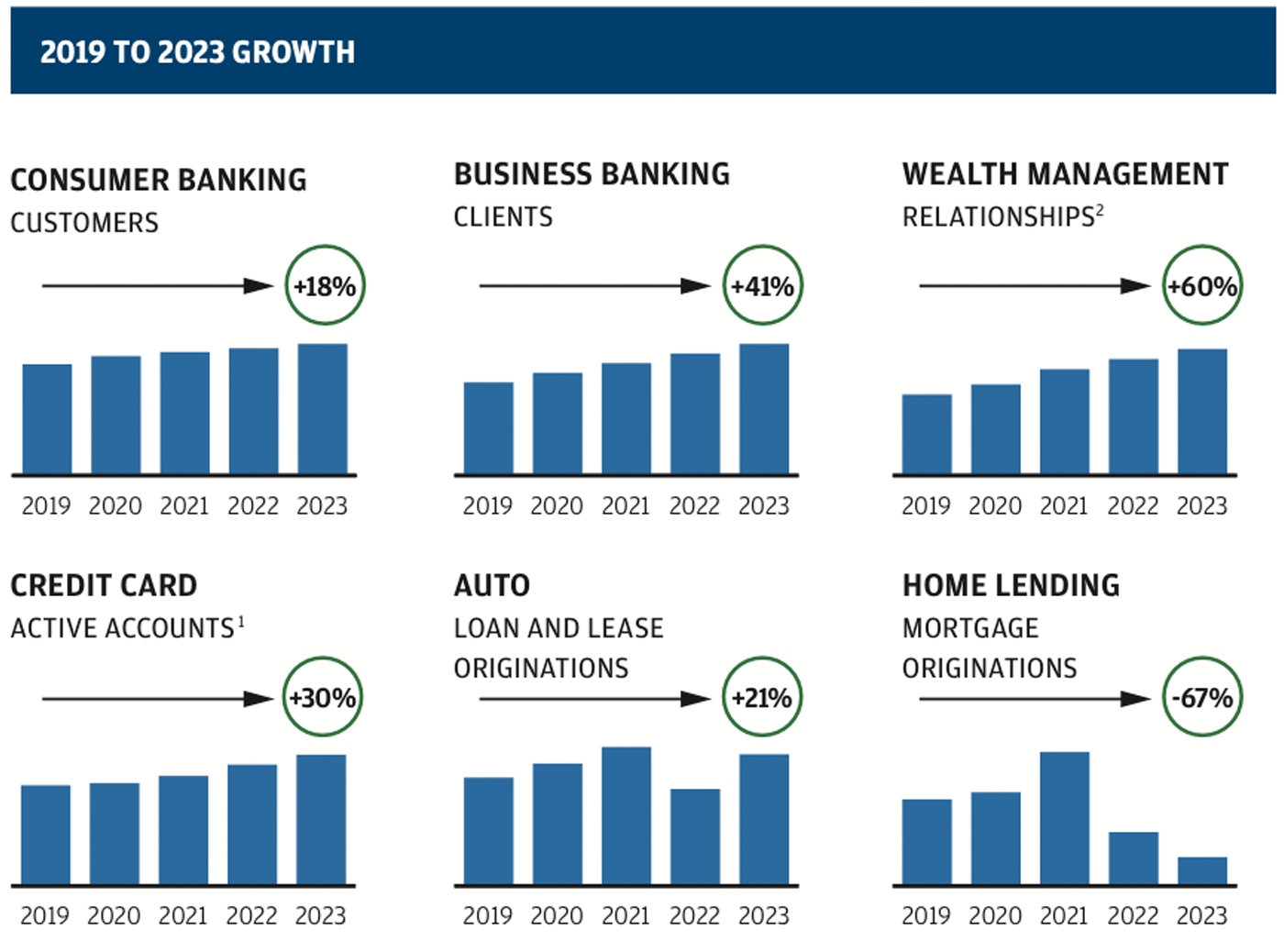

Our momentum is driven by successful execution across all lines of business in CCB. We’re the clear market leader in Consumer Banking, Business Banking and Card and continue to grow.

Consumer Banking

We extended our #1 position in 2023 with an 11.3% deposit market share, up 40 basis points from 2022. Excluding First Republic, share growth was up 10 basis points. Since 2019, we’ve increased our share by 220 basis points. We’ll continue to drive growth by expanding branches and evolving products to meet customer needs by segment.

Branches remain the hub for our local team of experts – over 50,000 bankers, advisors and business relationship managers – and a key distribution channel for all parts of the firm. We continue to optimize our network of over 4,800 branches as we aim to be within a 10-minute drive for 70% of the U.S. population. This will help us grow share in major metropolitan areas like Boston, Philadelphia and Washington, D.C., as well as states with mostly rural populations such as Alabama and Iowa, where we are also expanding our presence.

We’ve added more than 650 new branches in the last five years, by far the most of any bank in the U.S. We’re doubling down on that investment and will add 500+ branches over the next three years. The result is a significantly younger branch network, which creates embedded growth that already has driven share gains and will continue to do so for years to come. Newer or “unseasoned” branches represent more than $150 billion in incremental deposit upside as they mature. At the same time, we are consolidating older branches in certain markets in response to shifting customer behavior.

We aim to be the bank for all, so tailoring products, services and experiences for each customer segment and community is central to our strategy. We’re increasingly focused on supporting the financial health of customers and communities through digital and in-person resources, such as our nearly 150 dedicated Community Managers. We now have 16 Community Center branches and plan to open three more in 2024.

We started 2023 with a goal of maintaining primary bank relationships and capturing money in motion, and we did both. We retained over 95% of our primary bank customers and succeeded in deepening with investments and an enhanced, higher-yield product set – including competitive-rate CDs and the new J.P. Morgan Premium Deposit account. As a result, we successfully captured more than 80% of yield-seeking flows in 2023.

Business Banking

We offer small business owners a comprehensive product suite to help them start, run and grow their businesses. We’re #1 in small business primary bank share with 9.5% of a fragmented market and plan to grow by:

- Increasing banker capacity to better cover large clients, which drives higher retention, cross-product deepening and client satisfaction. In 2023, we added more than 350 bankers against our target of 1,000 incremental bankers.

- Rolling out value-added services like payroll, broadening our payment acceptance suite with new offerings such as invoicing (currently in pilot) and launching Tap-to-Pay, which enables merchants to accept card payments on their mobile devices.

- Continuing to expand support for small business owners in underserved communities through special purpose credit programs, one-on-one mentoring and local events.

Card

In 2023, we extended our #1 position in credit card, with sales and outstandings market share up approximately 50 and 30 basis points, respectively, compared with 2019