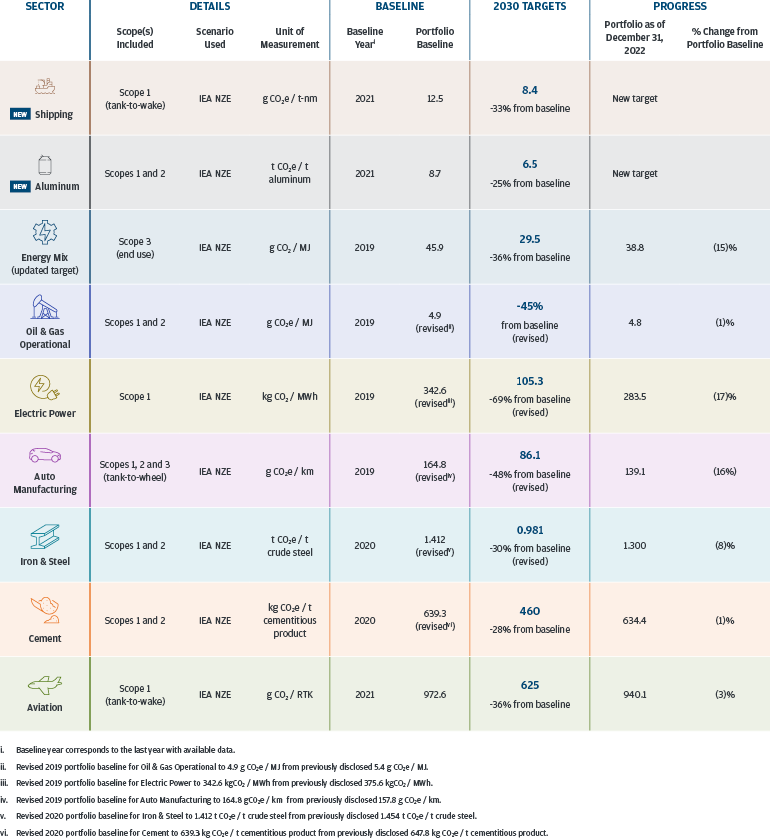

For the Shipping sector, our 2030 interim net zero aligned target is to reduce Scope 1 (tank-to-wake) emissions carbon intensity to 8.4 grams of CO2 equivalent per metric ton nautical mile, which is a 33% reduction from the 2021 portfolio baseline of 12.5 grams of CO2 equivalent per metric ton nautical mile. This is a new target, so no progress figures are shown for this sector.

For the Aluminum sector, our 2030 interim net zero aligned target is to reduce Scopes 1 and 2 emissions carbon intensity to 6.5 metric tons of CO2 equivalent per metric ton of aluminum, which is a 25% reduction from the 2021 portfolio baseline of 8.7 metric tons of CO2 equivalent per metric ton of aluminum. This is a new target, so no progress figures are shown for this sector.

For the updated Energy Mix target, our 2030 interim net zero aligned target is to reduce Scope 3 (end use) emissions carbon intensity to 29.5 grams of CO2 per megajoule, which is a 36% reduction from the 2019 portfolio baseline of 45.9 grams of CO2 per megajoule. As of December 31, 2022, our Energy Mix portfolio carbon intensity was 38.8 grams of CO2 per megajoule, which is a 15% decrease from our 2019 portfolio baseline.

For the Oil & Gas Operational sector, our 2030 interim net zero aligned target, which includes Scopes 1 and 2 emissions, is a 45% reduction in operational carbon intensity from the revised 2019 portfolio baseline of 4.9 grams of CO2 equivalent per megajoule. As of December 31, 2022, our Oil & Gas Operational portfolio carbon intensity was 4.8 grams of CO2 equivalent per megajoule, which is a 1% decrease from our revised 2019 portfolio baseline.

For the Electric Power sector, our 2030 interim net zero aligned target is to reduce Scope 1 emissions carbon intensity to 105.3 kilograms of CO2 per megawatt-hour, which is a 69% reduction from the revised 2019 portfolio baseline of 342.6 kilograms of CO2 per megawatt-hour. As of December 31, 2022, our Electric Power portfolio carbon intensity was 283.5 kilograms of CO2 per megawatt-hour, which is a 17% decrease from our revised 2019 portfolio baseline.

For the Auto Manufacturing sector, our 2030 interim net zero aligned target is to reduce Scopes 1, 2 and 3 (tank-to-wheel) emissions carbon intensity to 86.1 grams of CO2 equivalent per kilometer, which is a 48% reduction from the revised 2019 portfolio baseline of 164.8 grams of CO2 equivalent per kilometer. As of December 31, 2022, our Auto Manufacturing portfolio carbon intensity was 139.1 grams of CO2 equivalent per kilometer, which is a 16% decrease from our revised 2019 portfolio baseline.

For the Iron & Steel sector, our 2030 interim net zero aligned target is to reduce Scopes 1 and 2 emissions carbon intensity to 0.981 metric ton of CO2 equivalent per metric ton of crude steel, which is a 30% reduction from the revised 2020 portfolio baseline of 1.412 metric ton of CO2 equivalent per metric ton of crude steel. As of December 31, 2022, our Iron & Steel portfolio carbon intensity was 1.300 metric ton of CO2 equivalent per metric ton of crude steel, which is a 8% decrease from our revised 2020 portfolio baseline.

For the Cement sector, our 2030 interim net zero aligned target is to reduce Scope 1 and 2 emissions carbon intensity to 460 kilograms of CO2 equivalent per metric ton of cementitious product, which is a 28% reduction from the revised 2020 portfolio baseline of 639.3 kilograms of CO2 equivalent per metric ton of cementitious product. As of December 31, 2022, our Cement portfolio carbon intensity was 634.4 kilograms of CO2 equivalent per metric ton of cementitious product, which is a 1% decrease from our revised 2020 portfolio baseline.

For the Aviation sector, our 2030 interim net zero aligned target is to reduce Scope 1 (tank-to-wake) emissions carbon intensity to 625 grams of CO2 per revenue ton kilometer, which is a 36% reduction from the 2021 portfolio baseline of 972.6 grams of CO2 per revenue ton kilometer. As of December 31, 2022, our Aviation portfolio carbon intensity was 940.1 grams of CO2 per revenue ton kilometer, which is a 3% decrease from our 2021 portfolio baseline.